- Taiwan says four employees of Apple supplier Foxconn arrested in China

- What internet data brokers have on you — and how you can start to get it back

- Cramer wants to buy more of this chipmaker, considers adding another cybersecurity stock

- Pharmacy deserts are appearing across U.S. as Rite Aid, Walgreens, CVS drug store closures spread

- Ozempic is driving up the cost of your health care, whether you can get your hands on it or not

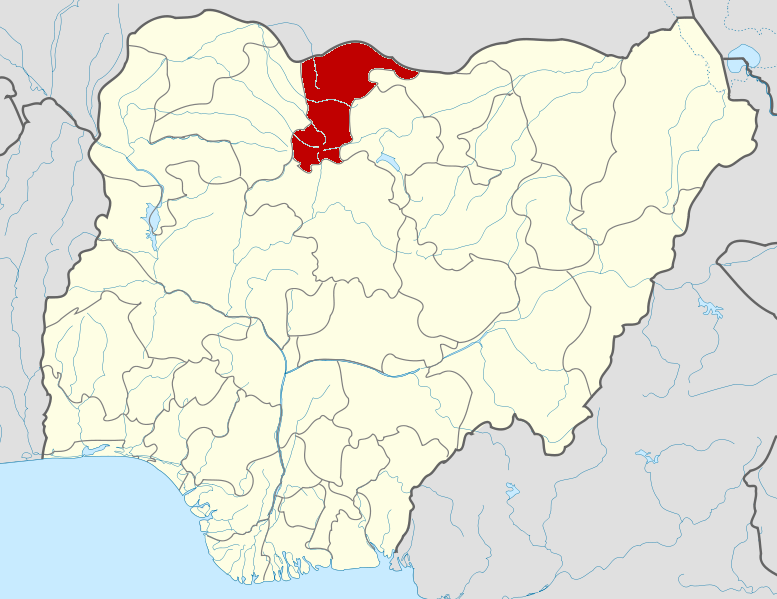

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Data brokers have long operated in the shadows of the internet, quietly amassing unprecedented amounts of personal information on billions of people across the globe, but few realize just how deep this data collection really goes. In an age where every move you make online — every click, every purchase, every "like" — is meticulously harvested, packaged, and sold for profit, aggregated personal data has become a valuable commodity, and the global data broker industry is proof of that. The rise of artificial intelligence tools poses the risk of even more personal information being scraped from the internet and an already opaque world of data brokering becoming even more aggressive, and that is heightening data privacy concerns. A 2023 study from Pew Research found that the American public increasingly says it does not understand what companies do with their data. According to Pew, 67% of Americans say they "understand little to nothing about what companies are doing with their personal data, up from 59% in its previous survey on the subject in 2019. A majority of Americans (73%) think they have "little to no control" over what companies do with their data. Many people are unaware that something as simple as their phone number can be used by data brokers and bad actors to uncover highly sensitive information, including a Social Security number, address, email, and even family details, said Arjun Bhatnagar, co-founder and CEO of Cloaked, an app that disguises your personal information by generating a unique "identity" for each online account you have. According to Roger Grimes, an expert at cybersecurity education firm KnowBe4, while many data brokers —especially the more well-known players — sell information responsibly, some of the smaller, unknown brokerages skirt regulations, push ethical boundaries, and exploit data in ways that can lead to misuse or harm. This is partly due to the hazy regulation landscape around data brokerage, which makes it easier for these practices to go unchecked. Some of the largest providers of data brokerage services include Experian, Equifax, TransUnion, LexisNexis, Epsilon (formerly Acxiom), and CoreLogic, according to a ranking from OneRep, an online personal data management service. People-search services Spokeo and Intelius are also among the top data brokers, according to OneRep. These companies operate across multiple industries, handling both publicly available information and more sensitive consumer data. They offer various services, ranging from marketing analytics to credit scoring and background checks, and all of them have processes for requesting your data or asking for it to be deleted. However, depending on the state you live in, they may not have to comply. Experian, Equifax and TransUnion are a good place to begin to understand how much the data industry has grown. While many consumers know these companies for their credit services, those are now just one piece of the revenue pie, with broader digital marketing of data increasingly important, according to Jeff Chester, founder and executive director of the Center for Digital Democracy, a Washington, D.C.,-based consumer privacy advocate. And data collection spans much farther across the economy, with companies from grocery stores offering discount programs to streaming video services amassing data that others will pay for. "Today, everyone is a data broker. Having the ability to reach someone online and target has become a core part of business," Chester said. "I try to lock down everything as much as I can, but I'm also aware that even though I'm a security expert, I'm probably overexposed," said Bruno Kurtic, president and CEO of data security firm Bedrock Security. As a basic step to limit financial risks, he recommends that all individuals freeze their credit reports as a proactive measure against identity theft and to prevent malicious actors from opening new accounts or loans in their name.

Inside data brokers' massive vault

Cybersecurity experts estimate that data brokers collect an average of 1,000 data points on each individual with an online presence. "It behooves them to collect as much as humanly possible about you, because the larger the information pool about you and the more specific they can get, the higher the cost of that data," said Chris Henderson, senior director of threat operations at Huntress, a cybersecurity company founded by former National Security Agency personnel. Here's a breakdown of the types of information data brokers typically collect, according to privacy experts interviewed by CNBC: Basic identifiers. Full name, address, phone number, and email.

Full name, address, phone number, and email. Financial data. Credit scores and payment history.