- GE Healthcare has been an under-the-radar winner — and a new catalyst just arrived

- Asia-Pacific markets set to open higher after Powell signals smaller rate cuts

- Watch Fed Chair Jerome Powell speak live on economy, policy views

- Hurricane Helene: Trump speaks in Georgia, bashes Harris for not traveling there

- Powell indicates further, smaller rate cuts, insists the Fed is 'not on any preset course'

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Valid certificates of origin key in taxing imports, Judge rules

For an importer to receive preferential tariff treatment in Uganda for goods imported from a COMESA member state, those goods must always be accompanied by a valid certificate of origin, properly filled out and authenticated, the High Court has ruled.

“Finally, it (certificate of origin) should contain the declaration by the exporter, by way of a stamp and an original signature, that the details in the first boxes are true and correct and that the goods in the consignment originate from the named country of origin,” held Justice Patricia Mutesi of the Commercial Division of the High Court.

A certificate of origin is a document certifying the country where an imported commodity originated, widely used in international trade transactions and essential for determining applicable taxes.

The Court in its judgment made on July 30, 2024, determined that the primary responsibility lies with the importer to provide documents that comply with the law, while the Uganda Revenue Authority (URA) is responsible for receiving, reading, and analysing these import documents, including certificates of origin.

- October 1, 2024

Rivers October 5 LG elections must hold, Fubara insists

- September 30, 2024

Fisherfolks to have solar powered outboard motors—Bawumia

- October 1, 2024

How Ruto has singlehanded dismantled Mt Kenya region politically

- September 30, 2024

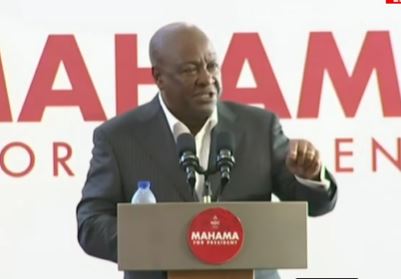

Mahama’s full speech at NDC Women’s Manifesto launch

- September 30, 2024

Busia set for Uganda's 62nd Independence anniversary - organizers

- September 30, 2024

Voter's Register: Let’s have evidence during IPAC Meeting

- September 30, 2024

There is a need for forensic audit of voter’s register – Nana Yaa Jantuah

- September 30, 2024

Vote massively for NPP to continue the transformation of the nation

- October 1, 2024

Impeachment D-Day: MPs prepare damning grounds to axe Gachagua

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!