- Hurricane Milton heads for Florida: Predicted path and what to expect

- Houthi Red Sea attacks still torment global trade, a year after October 7

- Bad call from Wall Street analysts on DuPont stock may be good news for investors

- Crypto relationship scams pose 'catastrophic harm,' SEC official says. Here's how to avoid them

- Trump's Mar-a-Lago, golf resorts are outside Milton's path. But Truth Social's offices are at risk

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Mbadi blames revenue shortfalls on KRA's outdated tax systems

Kenya Revenue Authority staff assists a client to file tax returns in Nyeri. [File, Standard]

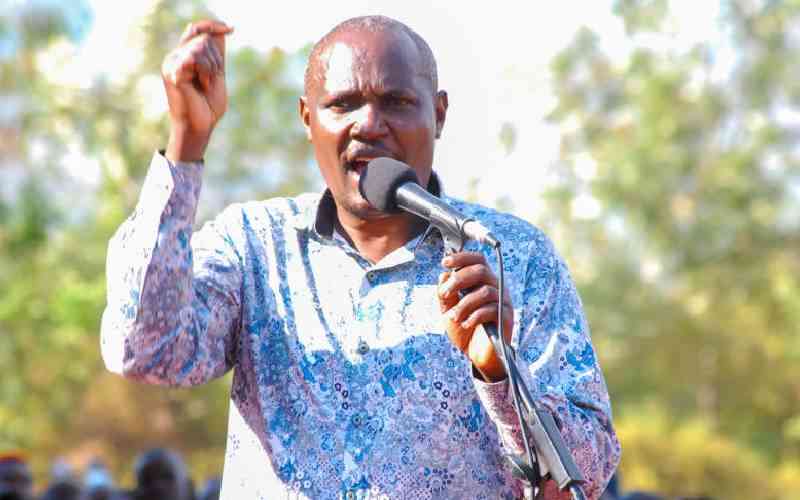

The National Treasury and Economic Planning Cabinet Secretary John Mbadi has laid bare the challenges facing revenue collection, saying that some of the taxman’s systems are not working optimally.

The CS, who was speaking during the ongoing Kenya Revenue Authority (KRA) Summit 2024 in Nairobi, Monday, cited iTax and the iCMS (Integrated Customs Management System), as some of the systems that are either outdated or not working as they should.

While KRA’s revenue collection has been increasing progressively in the last five years, hitting Sh2.4 trillion in the 2023/24 financial year, out of the target of Sh2.5 trillion, Mbadi said that there is more potential in the economy citing VAT as one of the areas.

He blamed the systems for failure by the taxman to collect revenue commensurate to the size of Kenya’s economy.

- October 7, 2024

Cryptocurrency Kaspa Down More Than 4% Within 24 hours

- October 7, 2024

Signal Alliance Technology Holding gets ISO certifications

- October 8, 2024

Oil prices nears $80 mark amid Middle East tensions

- October 8, 2024

Tetra Pak, WeCyclers partner on waste management

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!