- Oura announces new smart ring with updated design and new sensors for $349

- Hong Kong stocks fall as stimulus rally fizzles; Japan's Nikkei leads gains in Asia

- Dollar hits one-month peak to yen as Fed seen taking time with rate cuts

- Oil rises as Middle East conflict deepens, gains capped by global supply outlook

- Gold rangebound as investors brace for key U.S. economic data

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Japan still expected to stick to hiking cycle despite PM Ishiba's dovish turn

Despite dovish comments from Japanese Prime Minister Shigeru Ishiba leading to a sharp plunge in the yen , market analysts aren't budging from their Bank of Japan policy expectations for the longer term.

The yen slid to as weak as 147.15 against the U.S. dollar after Ishiba told reporters that the current economic climate does not require an additional rate increase. The currency clocked its largest single-day decline since June 2022 during the session.

"I do not believe that we are in an environment that would require us to raise interest rates further," Ishiba said on Wednesday after meeting with Bank of Japan Governor Kazuo Ueda — who leads the rate-setting committee at the bank. The prime minister's comments marked a drastic change in tone compared with the messaging on his recent campaign trail.

"This shift is particularly notable as the prime minister has been a long-time critic of past Liberal Democratic Party administrations, including the late Abe Shinzo's, whose 'Abenomics' was associated with monetary easing," said Stefan Angrick, senior economist at Moody's Analytics.

"My money is still on a rate hike in October," Angrick told CNBC, noting that the latest BOJ meeting minutes from September still held an optimistic view of the economy.

The futures market on Thursday implied less than a 50% chance that the BOJ could hike by 10 basis points before the end of the year, according to LSEG data.

- October 2, 2024

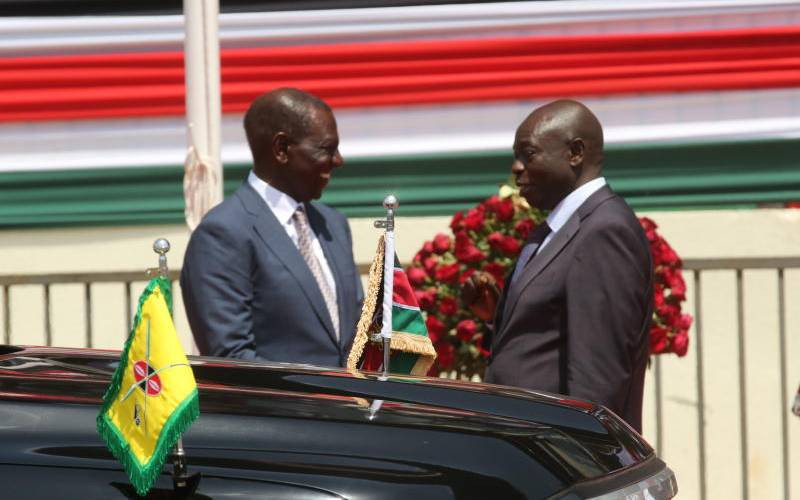

Ruto's silence on Gachagua's impeachment raises questions

- October 2, 2024

Mahama promises an extra one day for Eid-ul Fitr holiday

- October 3, 2024

LG election: Abia LP rejects Abure’s LG election committee list

- October 2, 2024

Dr Bawumia is fully prepared to be president — Prez Akufo-Addo

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!