- Iran's response to Israel will be a choice between revenge and survival. Markets say it's choosing survival

- Rupert Murdoch’s property group REA ends chase to buy Rightmove after multiple rejected offers

- 6 strategies to help mitigate rising car and home insurance costs

- 'No challenges can stop China's progress' Xi Jinping says in 75th anniversary speech

- China stocks just had their best day in 16 years, sending related U.S. ETFs soaring

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Forex crisis: Nigeria’s foreign trade payments crash by 57%

A Letter of Credit is a mode of payment used for the importation of visible goods.

It is a written undertaking given by s bank (issuing bank) at the request of its customer in which the bank promises in writing to pay the exporter a certain sum within a certain time frame in return for goods, as long as the customer provides the bank with the proper paperwork.

In the period under review, the country’s LCs payment shed about $520.44m, which some analysts have blamed on factors like the exit of multinationals, skyrocketing customs duties, and the unstable foreign exchange, which hampered Nigeria’s foreign trade in the period under review.

An analysis of the CBN data showed that the highest LC payments this year were recorded in February at $102.59m, followed by July at $79.65m and $58.33m in January.

In March, LCs payments stood at $43.53m compared to $269m in the same month in 2023, rose to $54.02m in April 2024 and dropped to $21.48m in May before rising to $32.26m in June.

- September 30, 2024

We have enough dollar reserves to deal with Christmas festivities pressures

- September 30, 2024

Beta Glass, Access Holdings, Prestige Assurance top stock picks this week

- September 30, 2024

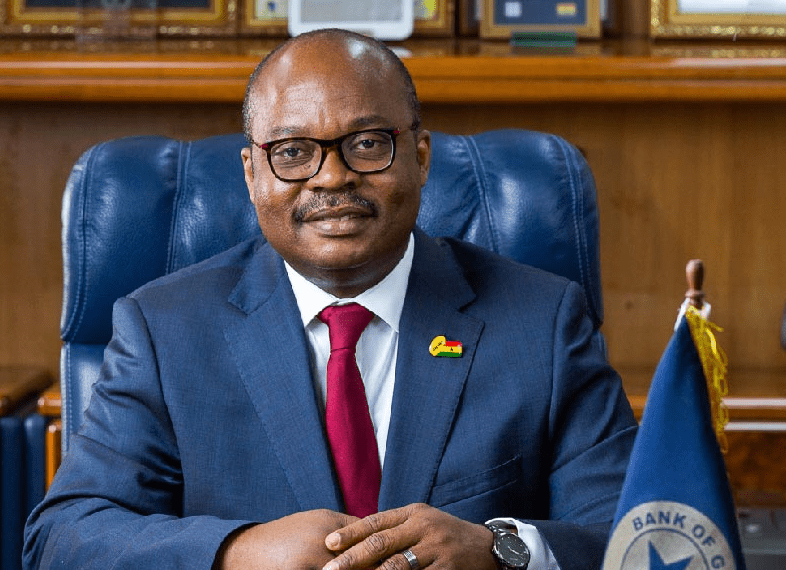

Policy reforms, ease of doing business, and foreign investments in Ghana

- September 30, 2024

Centum Re hands over sold-out Sh1bn luxury apartments

- September 30, 2024

Sanwo-Olu urges increased investment to combat coastal flooding

- September 30, 2024

Naira-for-crude deal begins Tuesday – Tinubu panel

- September 30, 2024

Lancaster experts weigh in on tankless water heaters

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!