- Cybersecurity firm Proofpoint considers pre-IPO funding as it plots a return to public markets

- CVS is working with advisors on strategic review, sources say

- Oil steady as prospect of more supply offsets Middle East conflict worries

- Dollar firm after Powell pushes back on aggressive easing bets

- European markets kick off October trading on a high note; euro zone inflation data in focus

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Dollar firm after Powell pushes back on aggressive easing bets

The U.S. dollar gained against major peers on Tuesday after Federal Reserve Chair Jerome Powell pushed back overnight against bets on more supersized interest rate cuts.

The euro traded not far from Monday's one-week low following a drop in German inflation to the lowest since early 2021, boosting speculation about another rate reduction this month.

The yen steadied close to the middle of its range against the dollar over the past month, after a volatile two days as traders sized up Japan's incoming prime minister and his cabinet.

Australia's dollar caught its breath following its push to the highest since February of last year on Monday, buoyed by stimulus in the country's top trading partner, China.

The Fed's Powell adopted a more hawkish tone in a speech at a conference in Tennessee, saying the U.S. central bank would likely stick with quarter-percentage-point interest rate cuts moving forward. "This is not a committee that feels like it is in a hurry to cut rates quickly," he said.

Traders remain certain that the Fed will cut again at the next policy setting meeting in November, but slashed expectations for a 50 basis-point reduction to 35.4% from 53.3% a day earlier, according to CME Group's FedWatch Tool.

- October 1, 2024

German antitrust watchdog steps up monitoring of Microsoft

- October 1, 2024

Concentric closes GO Engineering acquisition

- October 1, 2024

Firms warm up to usage-based insurance to grow penetration

- October 1, 2024

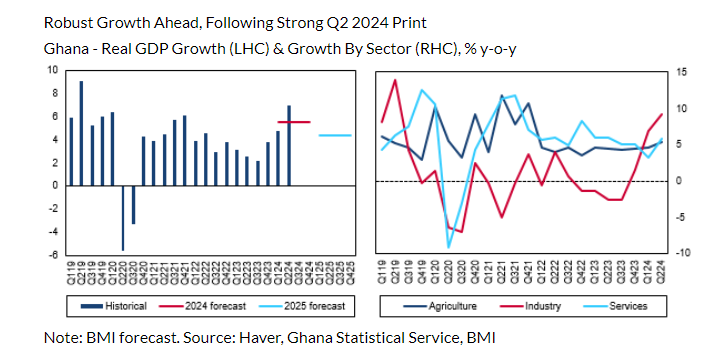

Ghana’s economy to rise to 3-year high of 5.5%

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!