- Hurricane Milton heads for Florida: Predicted path and what to expect

- Houthi Red Sea attacks still torment global trade, a year after October 7

- Bad call from Wall Street analysts on DuPont stock may be good news for investors

- Crypto relationship scams pose 'catastrophic harm,' SEC official says. Here's how to avoid them

- Trump's Mar-a-Lago, golf resorts are outside Milton's path. But Truth Social's offices are at risk

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Cutting emissions the smart way: How an intensity-based approach drives real change

Investors' consideration of a firm's environmental performance, along with concerns about future impacts on profit, have led many firms to start trying to reduce their carbon footprint. But such environmental pressure—if not calibrated correctly—may backfire.

In a new study, Tepper School researchers have explored how firms' operational strategies differ depending on the environmental metric used to assess environmental impact. The study, "Greenness and its Discontents: Operational Implications of Investor Pressure," is published as a working paper in the SSRN Electronic Journal.

The researchers found that significantly high environmental pressure from the market may result in different operational strategies under different disclosure regimes, with variations in the erosion of the firm value and environmental outcomes.

"Environmental pressure from both equity and debt investors can influence firms' value, which in turn affects stock prices and the cost of debt," explains Alan Scheller-Wolf, Professor of Operations Management at Carnegie Mellon's Tepper School of Business, who worked on the study, along with Sridhar Tayur, Professor of Operations Management at Tepper, and Tepper doctoral student Nilsu Uzunlar.

The positive impact of investor pressure manifests in its ability to foster sustainable business practices, such as investments to mitigate emissions. But there is evidence that under such pressure, firms may respond by selling their carbon-intensive assets to private companies. This reduces transparency and eliminates investor oversight, potentially leading to worse overall societal outcomes that may include increased pollution, higher unit prices, and lower employment.

- October 8, 2024

US industrial policy may strengthen EV battery supply chain

- October 8, 2024

Polymath Real Estate unveils Aura City

- October 8, 2024

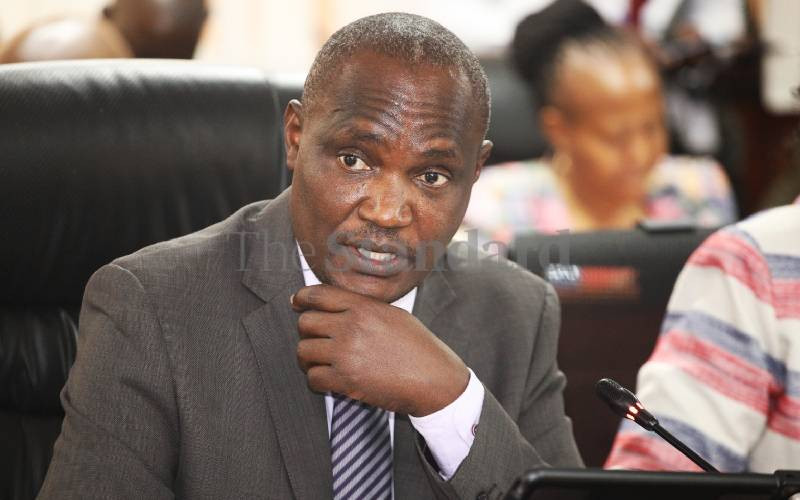

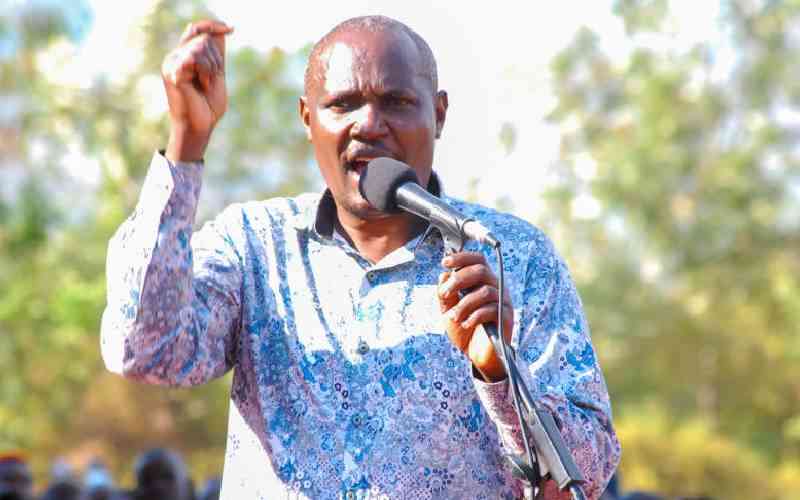

Mbadi blames revenue shortfall on KRA's outdated tax systems

- October 8, 2024

Mbadi blames revenue shortfalls on KRA's outdated tax systems

- October 8, 2024

Cooperative Bank seeks to strengthen ties with NGOs

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!