- Abu Dhabi wave pool added as new venue on World Surf League 2025 tour

- Photos: 3 million lose power as Hurricane Milton makes landfall in Florida

- CNBC's Inside India newsletter: Is China's stock market rally behind Indian equity losses?

- The Fed is finally cutting rates, but banks aren't in the clear just yet

- Berkshire slashes Bank of America stake to under 10%, no longer required to disclose frequently

What do you believe is the single most important factor driving up the cost of living in Nigeria?

CNBC's Inside India newsletter: Is China's stock market rally behind Indian equity losses?

China's CSI 300 index has gained about 25% since the stimulus measures were announced. Meanwhile, India's Nifty 50 has fallen by more than 3.5%. Seven of the past 10 trading days have been losers for Indian equities, while China stocks have risen every day except one, according to CNBC's count.

China appears to have become the preferred investment destination for market participants after Beijing unveiled its most aggressive monetary stimulus package since the coronavirus pandemic, coupled with support for its flailing property market.

The investment world has quickly swapped its insignia over the past couple of weeks. But that's justifiable when one's allegiance is entirely geared toward investment returns.

The causal link between the two equity markets over the past two weeks raises the question of whether stellar returns in India have come at the cost of falling Chinese asset prices over the past four years. More importantly, could this reverse in the near future?

In the short term, there appears to be some evidence linking China's gain to India's losses. Citi strategists cautiously observe that "when there were significant outflows from China, we have seen a similar pick up in inflows to India".

- October 10, 2024

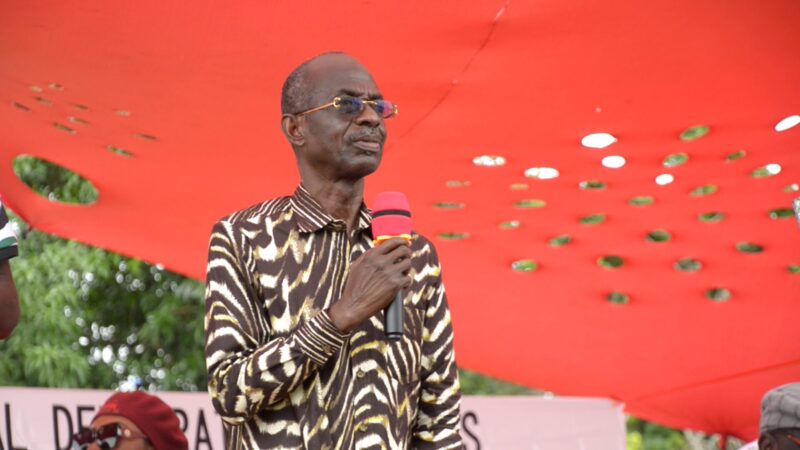

'Do not take NDC’s victory for granted'

- October 10, 2024

Women entrepreneurs get Shs18b GROW loans in one month – Amongi

- October 10, 2024

Deploying military alone won't curb galamsey menace

- October 10, 2024

Lira hospital struggling with rising patient numbers

- October 10, 2024

NDC does not want power to loot the state

- October 10, 2024

Akufo-Addo orders more troops to fight galamsey

- October 10, 2024

Otumfuo urges Samira Bawumia to campaign with humility and respect

- October 10, 2024

Tributes pour in for Ratan Tata from industry titans and politicians

- October 10, 2024

Election not religious contest – GPCC to political parties

- October 10, 2024

Soroti hospital staff, two others arrested over gas cylinder theft

- October 10, 2024

Afram Plains chiefs, religious leaders back NPP for 2024 polls

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!