- Hurricane Milton heads for Florida: Predicted path and what to expect

- Houthi Red Sea attacks still torment global trade, a year after October 7

- Bad call from Wall Street analysts on DuPont stock may be good news for investors

- Crypto relationship scams pose 'catastrophic harm,' SEC official says. Here's how to avoid them

- Trump's Mar-a-Lago, golf resorts are outside Milton's path. But Truth Social's offices are at risk

What do you believe is the single most important factor driving up the cost of living in Nigeria?

CBN withdrew N1.3tn from banking system in Sept — Report

However, that was largely offset by the CBN’s auctions, which included N622.7bn from NTB sales and N712.5bn from OMO issuances, effectively tightening liquidity.

In a bid to further manage liquidity, the CBN raised its Monetary Policy Rate and Cash Reserve Ratio to 27.25 per cent and 50 per cent, respectively, constraining interbank lending by keeping a portion of bank deposits with the central bank.

It noted that despite those restrictive measures, system liquidity closed the month at N253.6bn, recovering from a negative position in August.

The CBN’s actions had notable effects on the money market, as the overnight policy rate and open buyback rates surged by 9.9 percentage points and 8.7 percentage points month-on-month, closing at 28.0 per cent and 28.7 per cent, respectively.

Afrinvest attributed that to increased demand for interbank funds amid the tightening monetary conditions.

- October 7, 2024

Signal Alliance Technology Holding gets ISO certifications

- October 8, 2024

Artal Developments Archives

- October 8, 2024

DBN wins two SME finance awards

- October 7, 2024

Cryptocurrency Kaspa Down More Than 4% Within 24 hours

- October 8, 2024

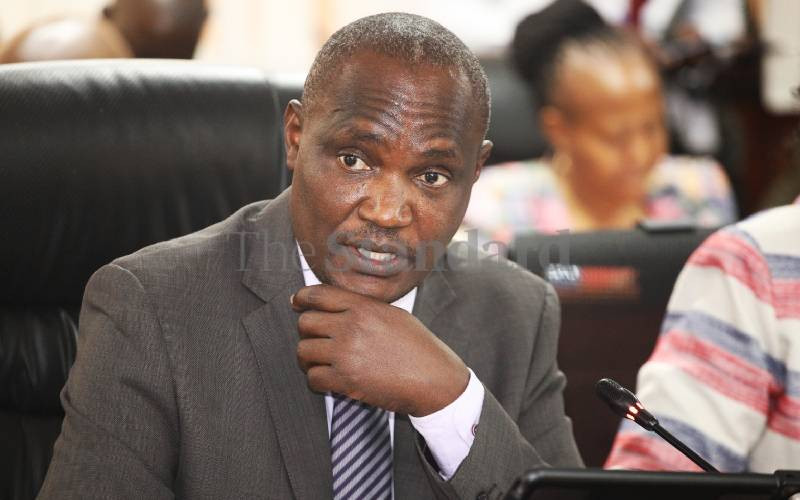

Mbadi blames revenue shortfall on KRA's outdated tax systems

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!