- Iran's response to Israel will be a choice between revenge and survival. Markets say it's choosing survival

- Rupert Murdoch’s property group REA ends chase to buy Rightmove after multiple rejected offers

- 6 strategies to help mitigate rising car and home insurance costs

- 'No challenges can stop China's progress' Xi Jinping says in 75th anniversary speech

- China stocks just had their best day in 16 years, sending related U.S. ETFs soaring

What do you believe is the single most important factor driving up the cost of living in Nigeria?

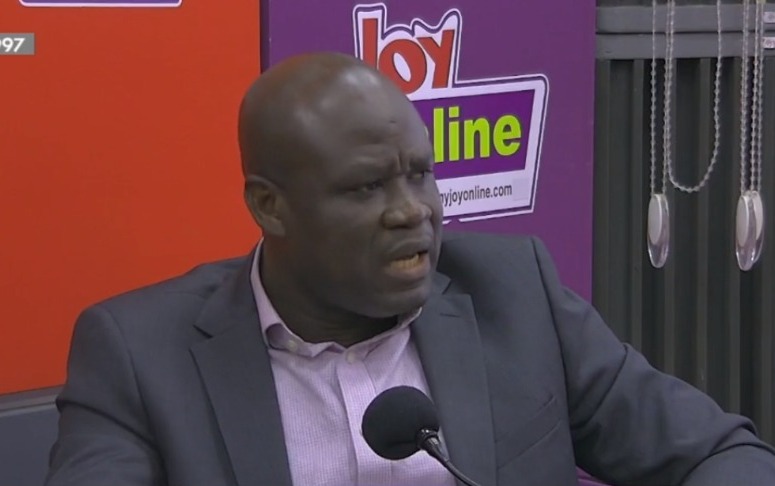

CAC, FIRS must partner to improve tax collections – Constancy boss

NEITI is known as the chief auditor of all extractive industries. My background as an accountant and an auditor will greatly impact the role that we play there. It is about transparency and accountability. The way we operate here may be a little bit different from what is obtained in the United States.

How do you intend to balance this difference?

Well, I don’t really see much difference in the way we operate. Accounting is accounting, finance is finance. So, it is just common sense. All you need to do is make sure you comply with the rules and regulations. If there is any reason for anyone not to adhere to the rules and regulations, there will be enforcement. Once you have identified that you have not been complying with the law, we will enforce to make you adhere to the rules and regulations.

How do you think the issue of revenue leakages could be addressed in the extractive industry?

Find a way to checkmate loopholes and leakages. One of the things that I will say to strengthen accountability is to quickly have a timely policy decision on the extractive industry to meet the needs of our people. We need a timely policy decision to address that issue. Another thing that we need to do, as I have mentioned earlier, is to strictly enforce compliance. All investors, mining organisations, and corporations must register with the Mining Cadastre Office, the MCO. We need to make sure we have adequate data. We have to do data gathering. I know NEITI has a lot of data. They have done a lot of collection in terms of data, and that can be seen on their webpage. They have done a very good job with data collection, but there is more to what we can do. More importantly, from the zonal offices.

- September 30, 2024

UPDATED: World Bank okays $1.57bn loan for Nigeria

- September 30, 2024

Taxes are suffocating businesses – GNCCI CEO calls for urgent tax reforms

- September 30, 2024

Epic Games sues Google and Samsung over app store

- September 30, 2024

FAT BEAR WEEK CELEBRATES 10TH ANNIVERSARY

- September 30, 2024

Naira-for-crude deal begins Tuesday – Tinubu panel

- September 30, 2024

Where flood policy helps most—and where it could do more

- September 30, 2024

Building technology deficit affecting industry growth, say operators

- September 30, 2024

UPDATED: UBA declares N316.4 billion half-year profit

- September 30, 2024

Pelican Valley woos diasporan investors

- September 30, 2024

Lancaster experts weigh in on tankless water heaters

- September 30, 2024

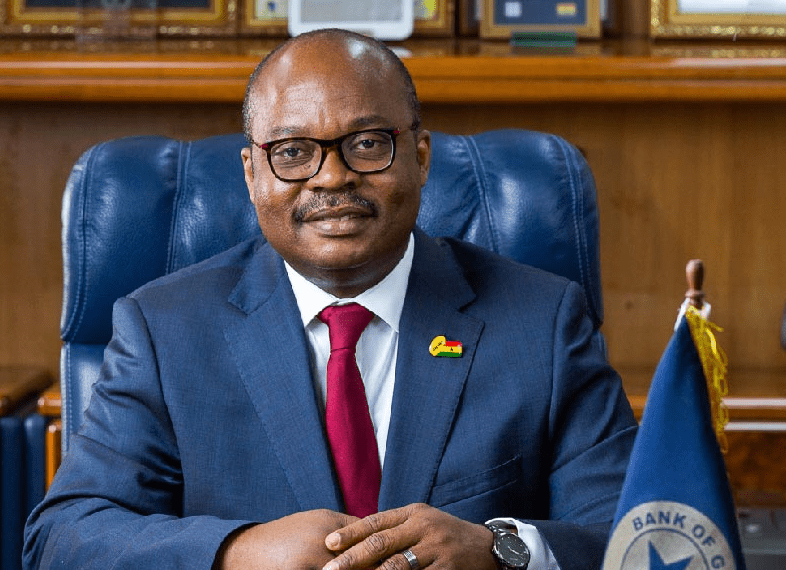

We have enough dollar reserves to deal with Christmas festivities pressures

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!