- Healthy Returns: Pfizer pulls sickle cell disease drug from markets – here’s why it matters

- With Hurricane Helene disrupting travel, here’s what fliers need to know

- Tesla set to report Q3 deliveries ahead of robotaxi event

- Port strike could reignite inflation, with larger economic impact dependent on how long it lasts

- 'Who's a good boy?' Humans use dog-specific voices for better canine comprehension

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Being 'mindful' about your bank account can bring more than peace of mind: A researcher explains the payoff

Mindfulness, the meditation practice that brings one's attention to present experiences, is gaining traction in the business world.

Researchers have long known that being mindful causes physical and mental benefits such as better brain health, decision-making and stress resilience. Major companies such as Google, Aetna and Intel offer mindfulness training programs as a way to boost employee well-being and productivity.

Building on this trend, financial products and services are starting to use the term "financial mindfulness" as a way to appeal to consumers. For instance, Fidelity talks about the importance of mindfulness in saving and investing, while PNC and Vanguard focus on regulating your emotions during financial planning.

Retailers offer financial mindfulness journals that claim to help people distinguish needs from wants and set financial goals. Books such as "Mindful Money" and "The Mindful Millionaire" explore how to achieve peace and prosperity through money management. Fintech has hopped on the financial mindfulness bandwagon, with apps such as Financial Mindfulness, Allo: Mindful Money Tracker and Aura, a mindful money management platform designed to "help you put your money to work and anxiety to rest."

But not everyone agrees on what "financial mindfulness" means—and does it even matter?

- October 2, 2024

Who's energy poor in the EU? It's more complex than it seems

- October 1, 2024

Treasury ruffled by KRA's bid to retain 2pc of total tax revenue

- October 1, 2024

How Russia-backed Africa Corps is destabilising markets

- October 1, 2024

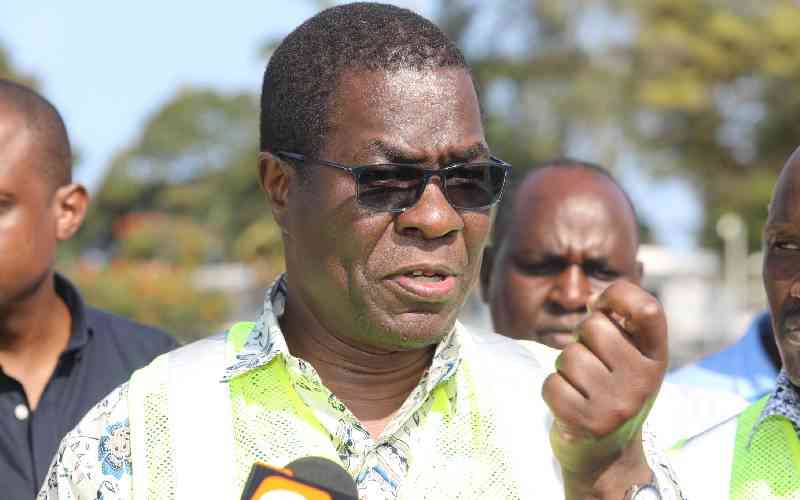

Wandayi says plans underway to curb power outage

- October 2, 2024

Empowering one woman at a time with Mama Fua app

- October 1, 2024

Talent 360 Aacquires Wish It, expanding HR solutions portfolio

- October 1, 2024

Cryptocurrency Sui Decreases More Than 4% Within 24 hours

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!