- Healthy Returns: Pfizer pulls sickle cell disease drug from markets – here’s why it matters

- With Hurricane Helene disrupting travel, here’s what fliers need to know

- Tesla set to report Q3 deliveries ahead of robotaxi event

- Port strike could reignite inflation, with larger economic impact dependent on how long it lasts

- 'Who's a good boy?' Humans use dog-specific voices for better canine comprehension

What do you believe is the single most important factor driving up the cost of living in Nigeria?

Bad loans in banking sector grow by 49.4% to GH¢20.4bn – BoG

The Bank of Ghana (BoG) has disclosed that Non-Performing Loans (NPL), that is credit that have gone bad in the banking sector increased by 49.4 percent to GH¢20.4 billion in June 2024, up from GH¢13.7 billion in the same period last year.

This, the central bank lamented reflects a deterioration in both domestic and foreign currency-denominated loans in the period under review.

“The asset quality of the banking industry declined during the period under review. The industry’s NPL ratio rose to 24.2 percent in June 2024, from 18.7 percent in June 2023”, the BoG said in its latest Monetary Policy Report.

The report explained that when adjusted for the fully provisioned loan loss category, the industry’s NPL ratio still increased to 10.8 percent in June 2024, from 7.8 percent, reflecting increasing stock of all categories of nonperforming loans.

“The rise in the NPL ratio during the period under review was explained by the higher growth in the NPL stock relative to the growth in total loans”.

- October 2, 2024

Polaris Bank emerges Nigeria’s top bank in MSME lending

- October 1, 2024

Bitcoin Cash Decreases More Than 5% Within 24 hours

- October 1, 2024

Cryptocurrency Pepe Falls More Than 5% In 24 hours

- October 1, 2024

How Russia-backed Africa Corps is destabilising markets

- October 1, 2024

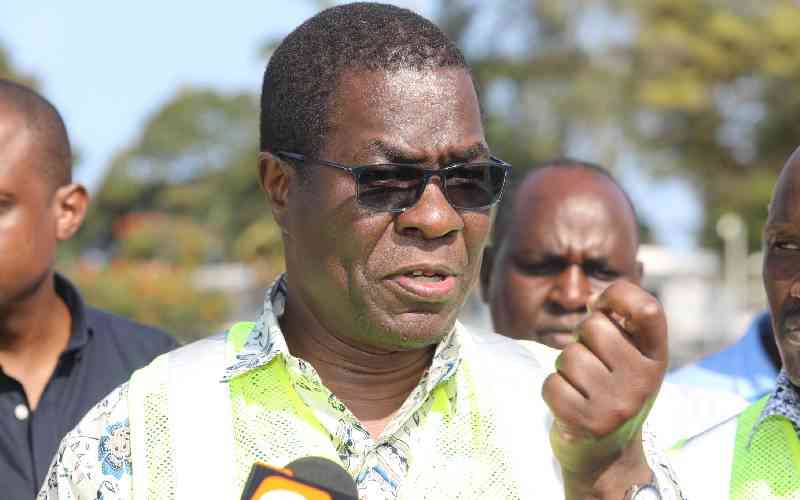

Wandayi says plans underway to curb power outage

- October 2, 2024

High costs slow widespread use of heat pumps in UK, study shows

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!