- Hong Kong's New World Development shares surge 23% after CEO resigns

- Oil prices fall as expectations of higher supplies hammer market sentiment

- Dollar drifts, risk-sensitive currencies lifted by China optimism

- Gold, silver head for weekly gains on U.S. rate-cut momentum

- OpenAI CFO tells investors funding round should close by next week despite executive departures

What do you believe is the single most important factor driving up the cost of living in Nigeria?

The Launch of the Commercial Paper Market in Ghana: What It Means for Industry and the Capital Markets

i. INTRODUCTION

Ghana has encountered significant economic challenges in recent times. These challenges have resulted from enormous strain on the country’s economy due to global geo-political developments coupled with domestic issues. The depreciation of the cedi, the dwindling of international reserves, financing pressures, the slowing down of economic activities, and soaring inflation prompted the government to seek help from the International Monetary Fund (IMF), resulting in a three-year Extended Credit Facility (ECF) of US$3 billion which is aimed at restoring macroeconomic stability and debt sustainability. One of the key reforms under this programme was the Domestic Debt Exchange Programme (DDEP). The DDEP has sought to restructure the government’s domestic debt to ensure long-term fiscal health. Even though this step was vital in the economic recovery of Ghana post covid, it profoundly impacted businesses and the financial sector, shaking investor confidence and limiting activity in the financial market.

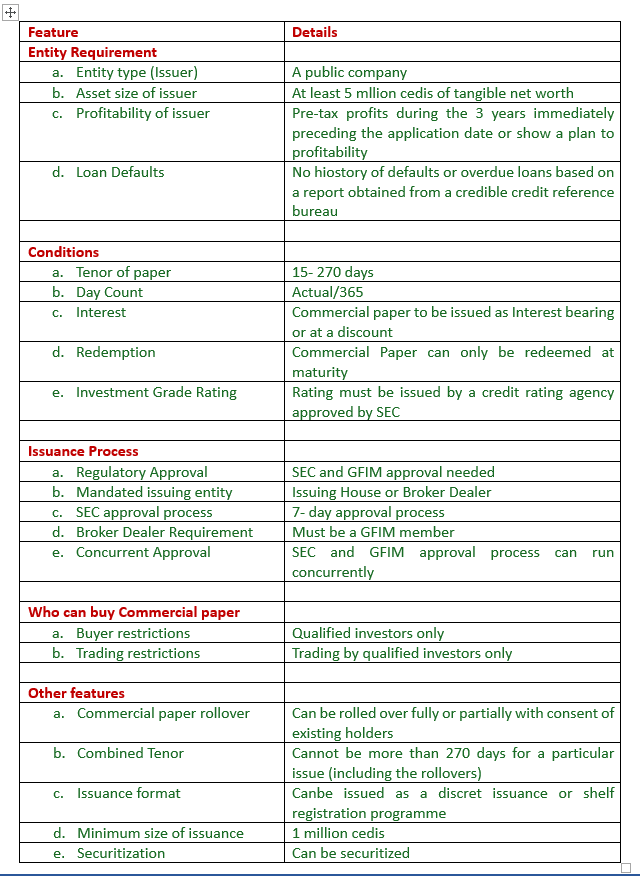

Against this backdrop, the Ghana Stock Exchange’s (GSE) recent introduction of the Commercial Paper Market, a pivotal milestone in the 10-year strategic Capital Market Master Plan (CMMP) launched in May 2021, must be applauded. The launch demonstrates the commitment of the GSE and the Securities and Exchange Commission (SEC) to promoting the development of a vibrant and dynamic capital market ecosystem in Ghana. The setup of a formal market for this very important money market instrument stands to offer several benefits including enhanced liquidity of the securities market, diversity of investment products making it more efficient and attractive to both local and foreign investors; diversified funding options for issuers, and a robust framework for investor protection.

ii. COMMERCIAL PAPER 101

- September 27, 2024

NMRC secures $228m to bridge housing deficit

- September 27, 2024

ExxonMobil unveils $10 billion investment plan in Nigeria – Presidency

- September 27, 2024

Petroleum industry owes Nigerian govt $6bn, N66bn – NEITI Report

- September 27, 2024

ExxonMobil to invest $10bn in Nigeria’s oil sector

- September 27, 2024

Alert Group eyes N200bn assets in five years

- September 27, 2024

Petrol landing cost drops to N981/litre

Subscribe to our mailing list to get the new updates!

Subscribe our newsletter to stay updated

Thank you for subscribing!